There's a lot of misinformation out there about the VA loan. Here's some thing you may not know:

During my two decades of service, misinformation has always been a major concern for me. Often, I was handed quick solutions instead of the accurate ones. As an expert on VA loans, you can trust the answers I provide. I take pride in assisting Veterans, realtors, and real estate agencies nationwide with their VA loan queries. If ever I'm unsure, I take the initiative to seek the correct answer.

From our first interaction to well after your home purchase, I remain your dedicated resource for all housing-related inquiries. Whether you need a lender for preapproval, an insurance broker for asset protection, or even a carpet cleaner post-purchase, my extensive network of trusted professionals ensures you receive only the best service.

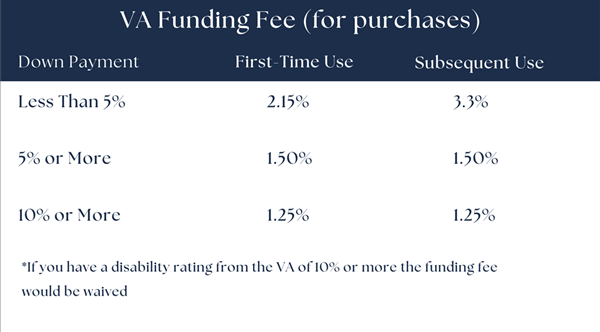

A VA loan advantage is the option for a zero-down payment. However, a funding fee is required, which many buyers incorporate into their mortgage. This fee is exempted for those with a VA disability rating of 10% or higher.

If you possess a VA disability rating of any percentage, the funding fee is waived for you. Not holding a rating yet? Let's discuss. I can introduce you to a specialist who can guide you in initiating your claim. I'd advise you to fill out the documentation via this link before finalizing a home purchase. This way, should your claim gain approval, we can ensure you receive a refund. To delve deeper into this, give me a ring at 612-408-1953.

VA Intent To File

Veterans who are totally and permanently disabled (100% T&P) are eligible for a valuation exclusion of $300,000 on their property tax value. Veterans who are not totally and permanently disabled, but who have a disability rating of 70 percent or higher, are eligible for an exclusion of $150,000. If a qualifying veteran does not own a house, but has a designated “primary family caregiver” who does own a house, the caregiver can receive the exclusion for the time he or she continues in that role.

Homestead Valuation Exclusion Form

I'm honored by the complete satisfaction my clients express regarding my services as their realtor. Browse their testimonials to see their feedback. I've consistently exceeded their expectations, and I promise to do the same for you.

Google ReviewsFor sale: Properties which are available for showings and purchase

Active contingent: Properties which are available for showing but are under contract with another buyer

Pending: Properties which are under contract with a buyer and are no longer available for showings

Sold: Properties on which the sale has closed.

Coming soon: Properties which will be on the market soon and are not available for showings.

Contingent and Pending statuses may not be available for all listings