There’s a lot of misinformation out there about the VA loan. Here are some key facts every veteran should know:

If you’re ready to take advantage of your VA loan benefits, let’s connect and make your homeownership goals a reality!

Misinformation has always been a concern for me, which is why I’m committed to providing accurate, reliable guidance on VA loans. As an expert in the field, I assist veterans, realtors, and agencies nationwide with their VA loan questions. From preapproval to post-purchase needs, I remain a trusted resource, connecting you with top professionals to ensure a smooth and successful homeownership journey. And of course I was double fisting in this photo...I'm a Veteran after all.

Connect With MeCurious about VA loan assumption? It allows a qualified buyer—Veteran or not—to take over a seller’s VA loan, often with a lower interest rate and reduced closing costs. Watch the video to learn how it works and why it can be a huge win in today’s market.

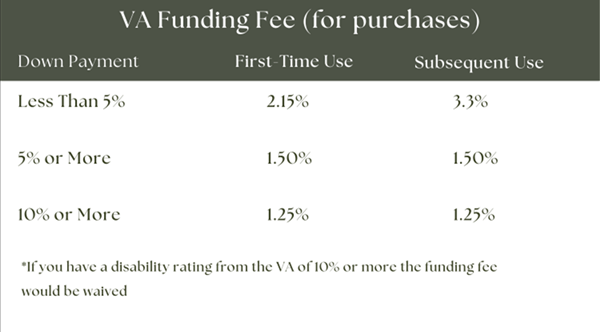

If you possess a VA disability rating of any percentage, the funding fee is waived for you. Not holding a rating yet? Let's discuss. I can introduce you to a specialist who can guide you in initiating your claim. I'd advise you to fill out the documentation via this link before finalizing a home purchase. This way, should your claim gain approval, we can ensure you receive a refund. To delve deeper into this, give me a ring at 612-408-1953.

VA Intent To FileVeterans who are totally and permanently disabled (100% T&P) are eligible for a valuation exclusion of $300,000 on their property tax value. Veterans who are not totally and permanently disabled, but who have a disability rating of 70 percent or higher, are eligible for an exclusion of $150,000. If a qualifying veteran does not own a house, but has a designated “primary family caregiver” who does own a house, the caregiver can receive the exclusion for the time he or she continues in that role.

Homestead Valuation Exclusion Form

A VA loan advantage is the option for a zero-down payment. However, a funding fee is required, which many buyers incorporate into their mortgage. This fee is exempted for those with a VA disability rating of 10% or higher.

I'm honored by the complete satisfaction my clients express regarding my services as their realtor. Browse their testimonials to see their feedback. I've consistently exceeded their expectations, and I promise to do the same for you.

Google ReviewsFor sale: Properties which are available for showings and purchase

Active contingent: Properties which are available for showing but are under contract with another buyer

Pending: Properties which are under contract with a buyer and are no longer available for showings

Sold: Properties on which the sale has closed.

Coming soon: Properties which will be on the market soon and are not available for showings.

Contingent and Pending statuses may not be available for all listings