The Gran Group works to provide a clear, understandable process for thier clients. Starting at the first buyer or seller consultation, all the way to the closing table, we proactively communicate what our clients can expect and help them understand thier options along the way. We've curated some Frequently Asked Questions that should be helpful to prepare you for your Real Estate journey.

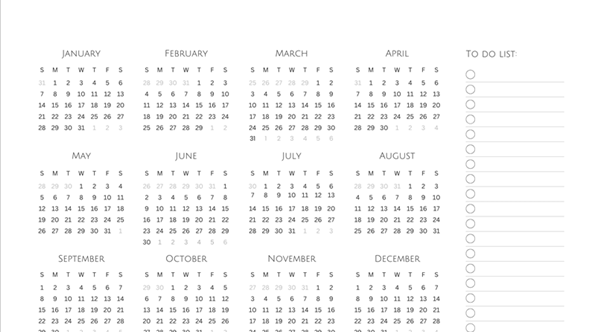

The timeline to buy a home usually takes 30 to 45 days once your offer is accepted, but the full process, from getting pre-approved to getting the keys, can take several weeks to a few months depending on your situation. In Minnesota and Wisconsin, the pace can shift based on market conditions, competition, financing, and local regulations.

Here’s a quick breakdown of what affects your timeline:

Pre-Approval: 24 hours to a few days. This is your first step and speeds up everything else.

Home Shopping: A few days to several weeks depending on inventory, price range, and how competitive your area is.

Offer Acceptance: Can happen quickly in slower markets, but in hot markets, like the Twin Cities or popular Wisconsin lake towns, it may take multiple offers.

Inspection Period: Typically 7–14 days, including general inspection, radon tests, well/septic checks, and any follow-up evaluations common in homes.

Appraisal & Underwriting: About 2–3 weeks, depending on your lender.

The amount you need for a down payment depends on your loan type, your financial goals, and the property you’re buying, but most homebuyers in Minnesota and Wisconsin put down anywhere from 3% to 20% of the purchase price.

Many buyers are surprised to learn that you don’t always need 20%. Here’s a quick breakdown of common options:

Conventional Loans: As low as 3%–5% down for qualified buyers.

FHA Loans: Minimum 3.5% down, ideal for first-time buyers or those with lower credit scores.

VA Loans: 0% down for eligible active-duty military, veterans, and surviving spouses.

USDA Rural Loans: 0% down for qualifying rural and small-town areas across Minnesota and Wisconsin.

Jumbo Loans: Usually 10%–20%+, depending on lender requirements.

It’s also important to budget for closing costs, which generally add another 2%–5% to your total cash needed at closing.

Preparing your home to sell in the Twin Cities starts with making it feel bright, clean, and move‑in ready for buyers. When your house feels well cared for, it photographs better, shows better, and usually attracts stronger offers.

Begin by decluttering and organizing each room so buyers can focus on the space, not your belongings. Remove family photos and very personal items so the home feels like a blank canvas where potential buyers can easily imagine their own furniture and lifestyle. Aim for clear surfaces, simple decor, and plenty of walking space.

Consider affordable updates that make a big visual impact, such as fresh paint in neutral colors and replacing worn or heavily stained carpet. A professional deep clean before listing, including floors, baseboards, windows, and bathrooms, helps your home feel airy, fresh, and well maintained. If you have pets, plan on a carpet cleaning or targeted odor treatment so buyers notice your home, not pet smells.

After your offer is accepted, a licensed home inspector evaluates the property’s major systems and structure. This typically includes the roof, foundation, electrical, plumbing, HVAC, and visible structural components. The home inspection report identifies safety concerns, deferred maintenance, and potential repairs.

Once the inspection is complete, we review the report together. Based on the findings, buyers may request repairs, negotiate seller credits, or, if significant issues arise, cancel the contract within the inspection contingency period.

Buyers also have the option to order specialized inspections, such as radon testing, chimney inspections, foundation evaluations, or other assessments if concerns arise. These can be completed before or after the general home inspection, as long as they fall within the inspection timeline.

Understanding the inspection contingency and its deadlines is critical.

Spring and Summer are the Most Active.

With more Sellers, there is more competition making it more difficult to stand out.

Fall offers less competition among other sellers allowing a Seller to stand out. Buyers are typically more motivated as they may want to move in and "nest" before winter starts.

Winter can offer a unique showing experience for sellers. Some properties show well in with the snow and when sellers have their homes decorated for the holidays, their home can show especially well.

Homes sell all year round and different seasons offer different advantages. Your reasons should take precedence and not the seasons.

For sale: Properties which are available for showings and purchase

Active contingent: Properties which are available for showing but are under contract with another buyer

Pending: Properties which are under contract with a buyer and are no longer available for showings

Sold: Properties on which the sale has closed.

Coming soon: Properties which will be on the market soon and are not available for showings.

Contingent and Pending statuses may not be available for all listings