Buying your first condo can be an exhilarating experience. Follow these tips as you determine if you’re financially ready to make the leap to condo ownership.

How do I know it’s time to buy a condo?

Every homebuyer reaches the decision to purchase a home in a different way, so there is no magic checklist that can help you decide to buy a condo for the first time. However, because condos offer the flexibility and freedom of homeownership while also taking on some of the maintenance and upkeep that can be pricey and time-consuming, they are often a good fit for:

- Renters who are ready to own

- Empty nesters or retirees who are ready to downsize

- Those who can afford to own, but wish for a low-maintenance residence

- Those looking to live in densely populated, urban areas

To understand what it’s like to live in a condo, read more about condo life.

What kind of credit and down payment do I need to buy a condo?

Every loan is determined based on the individual credit and financial history of the condo buyer, as determined by the lender, so there are no hard-and-fast rules for the types of buyers who will be approved.

In a very general sense, though, here are the minimum credit scores and down payment percentages that are required for the two major loan types:

- FHA loans: If a condo complex is approved for FHA loans, condo buyers may be approved with a credit score as low as 580 and as little as 3.5 percent down. But not all condos are FHA-approved.

- Conventional loans: The minimum credit score required for a conventional loan is typically 620 and the down payment minimum for these loans is likely between 3 percent and 20 percent.

Keep in mind that if you put down less at closing, your lender may require you to pay mortgage insurance.

Learn more about the major loan types and their terms.

If you have less-than-perfect credit or don’t think you have enough saved for a down payment, talking to a lender is the simplest way to understand your options.

I think I want to buy a condo, when should I meet with a lender?

While there’s no wrong time to contact a lender, if you’ve already selected your REALTOR®, they can often recommend and connect you with a trusted mortgage loan officer. Or, if you need help getting matched with a Realtor or loan officer, our customer care team can put you in contact with condo specialists.

Once you have a lender, you’ll want to get pre-approved. Pre-approval is a process where a lender reviews your financial and credit history, then helps you estimate your buying budget and interest rate (assuming rates hold).

While it’s not required to get pre-approved, home buying experts agree it’s an important first step. For many buyers, getting pre-approved helps to make the process more “real,” because it offers estimated budget parameters to shop within. Additionally, condo sellers and their agents may take you more seriously if you’re pre-approved.

How can I improve my credit score so I can be approved for a condo?

While your credit score can feel like a mystery number that dictates your ability to buy a condo (and take part in plenty of other financially-focused activities), it’s possible to take control of your score and work to improve it over time.

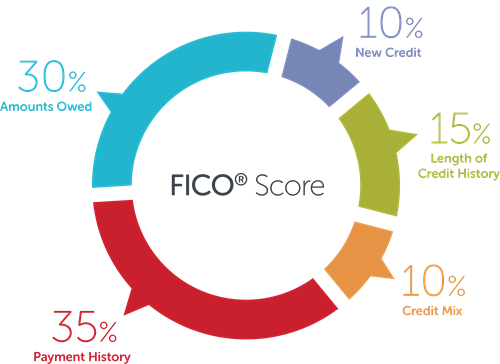

First, consider the five components of your credit score:

- Payment history — That you make consistent and on-time payments of both long-term loans (car or student loans) as well as revolving credit (credit cards).

- Credit utilization (amounts owed) — This metric gauges how much of your available credit you typically have extended. While you may think it’s smart to have a credit limit of $500 so you don’t rack up too much debt, you will end up being penalized if you average a monthly credit card bill of $400. Experts recommend that you utilize less than 30 percent of your available credit.

- Length of credit history — This takes into consideration how long you have had your accounts open and the last time you had a transaction in each account. Those with a mature credit history will have a higher score.

- New credit — While it’s frowned upon to open many new accounts at once, getting approved for new credit can indicate that other lenders find you to be a responsible borrower.

- Credit mix — This takes into account the variance of the types of accounts you’ve had in the past; applicable accounts can include everything from your student loans to your Target REDcard to your checking and savings accounts.

Now that we’ve defined how your credit score is created, you may see some easy changes you can make to help raise it.

If you’re still confused about what action to take, see how to build better credit.

How much does a condo cost?

As you might expect, paying for a condo is about more than just making the monthly mortgage payment.

The cost of buying a condo for the first time includes:

- PITI: Your mortgage principal and interest, plus your annual taxes and insurance

- Monthly condo HOA fees

- Parking and laundry costs, which may not be included in the purchase of your unit

- Maintenance of your individual unit

To get a feel for the typical price of condos in your desired area, check out condos for sale on edinarealty.com.

Key points and next steps

Hoping to start the process of buying your first condominium? Congrats! As you get started, be sure to

- Consider your credit score and financial history

- Work with your Realtor and lender to get pre-approved on a mortgage

- Calculate the total estimated cost of owning a condo

Not sure where to start? We can help. Reach out to our customer care team to get matched with the right condo expert.

Additional resources to consider

Condos 101: What are condominiums, anyway?

11 questions every condo buyer should ask

First-time home buying guide

10 tips for buying your first condo

©2026 Prosperity Home Mortgage LLC®. (877) 275-1762. 3060 Williams Drive, Suite 600, Fairfax, VA 22031. All first mortgage products are provided by Prosperity Home Mortgage, LLC®. Not all mortgage products may be available in all areas. Not all borrowers will qualify. NMLS ID #75164 (For licensing information go to: NMLS Consumer Access at

©2026 Prosperity Home Mortgage LLC®. (877) 275-1762. 3060 Williams Drive, Suite 600, Fairfax, VA 22031. All first mortgage products are provided by Prosperity Home Mortgage, LLC®. Not all mortgage products may be available in all areas. Not all borrowers will qualify. NMLS ID #75164 (For licensing information go to: NMLS Consumer Access at