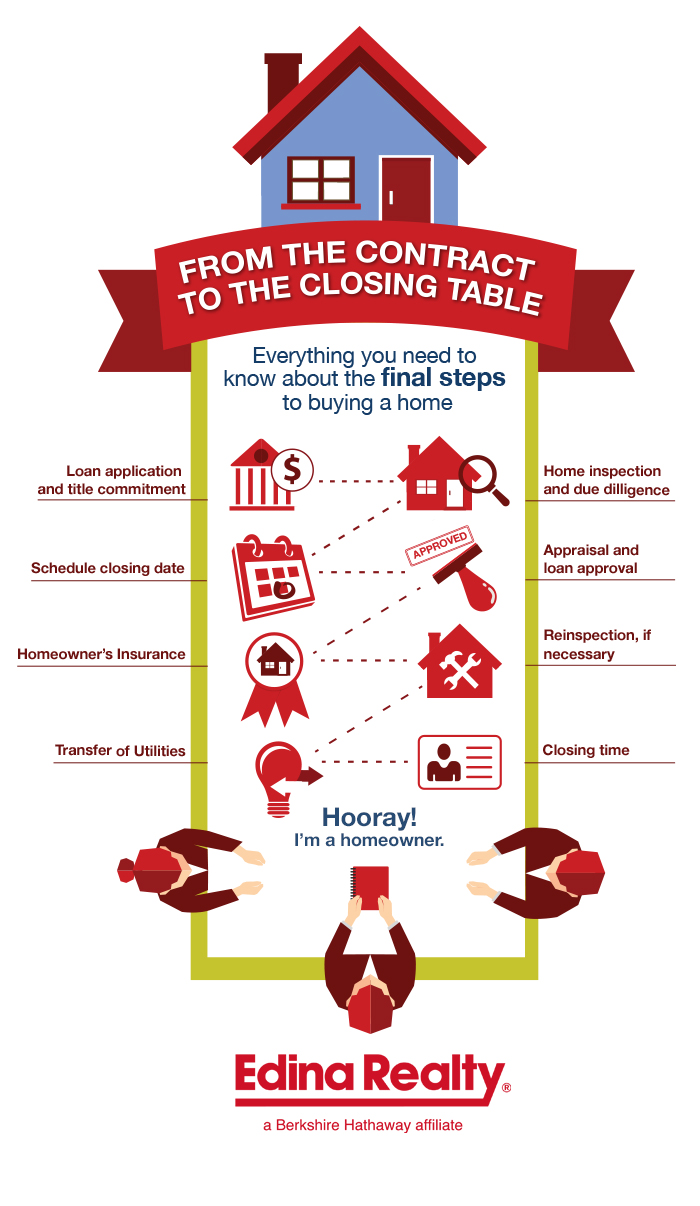

Wondering just what it takes to get from the accepted offer to the closing table? Below, we walk you through all the steps faced by homebuyers in Minnesota and western Wisconsin.

1. Loan application and title commitment

After negotiating the offer, you'll apply for a loan in an amount equal to or less than the amount for which you were pre-approved. You'll also give your financial and credit history to your home mortgage consultant. When you apply for the loan, a notification is sent to the seller's agent, and they'll monitor the loan approval process for their client. At this time, the title commitment is also ordered.

2. Home inspection and due diligence

Next, the home will be inspected fully by a licensed inspector that you, the buyer, choose and pay for. When you receive the report back, you can ask the seller about concerns you have about the property, request needed repairs, and you have the right to terminate the purchase agreement (contract) for any reason.

3. Schedule closing date

Next, Edina Realty Title schedules the closing date and time, and notifies all parties. At this point, the title commitment is prepared and reviewed by Edina Realty Title so it is ready for closing.

4. Appraisal and loan approval

Next, your lender will have the property appraised, so they can be sure that the home's value is high enough to justify the loan. Once the appraisal goes through and your financial and credit history is verified, your lender will approve your home mortgage loan. The loan package is submitted to the title company, which prepares the closing documents and gives the buyer the final cost of purchase.

5. Homeowner's insurance

The lender requires homeowner's insurance be purchased, and the seller's agent will ensure that the coverage will satisfy the lender's requirements. It's important that the policy be finalized and available at the closing.

6. Reinspection, if necessary

If the due diligence negotiations required the seller to make repairs, then you should have the property inspected again to ensure that the repairs were completed in full.

7. Transfer of utilities

Before closing, the utilities should be transferred to you from the seller. The seller should notify the utility companies to cancel their coverage on the day of closing, and you should set up coverage from closing day and beyond.

8. Closing time

At closing, Edina Realty Title performs the closing, disburses funds and submits the deed to the county for recording. You should bring the following to closing:

- A valid photo ID

- Social security number

- Wired funds for the amount specified in the most recent good faith estimate you received from your loan officer or lender

- A checkbook, in case of other charges

- New homeowner’s/hazard insurance binder and paid receipt

©2026 Prosperity Home Mortgage LLC®. (877) 275-1762. 3060 Williams Drive, Suite 600, Fairfax, VA 22031. All first mortgage products are provided by Prosperity Home Mortgage, LLC®. Not all mortgage products may be available in all areas. Not all borrowers will qualify. NMLS ID #75164 (For licensing information go to: NMLS Consumer Access at

©2026 Prosperity Home Mortgage LLC®. (877) 275-1762. 3060 Williams Drive, Suite 600, Fairfax, VA 22031. All first mortgage products are provided by Prosperity Home Mortgage, LLC®. Not all mortgage products may be available in all areas. Not all borrowers will qualify. NMLS ID #75164 (For licensing information go to: NMLS Consumer Access at