There is no question that first-time buyers — whose budgets and down payments tend to be more modest — are deeply affected when mortgage interest rates increase. Here are insights you can use if you’re a first-time homebuyer in Minnesota or western Wisconsin.

How affordability works

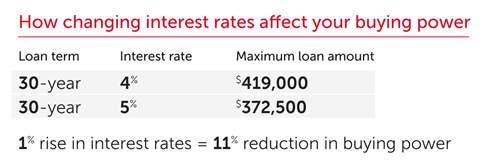

Affordability is easier to understand when you can review a few examples. Let’s run the numbers.

Let’s say a homebuyer has $2,000 to spend on their monthly mortgage payment. If rates are 4 percent and the borrower secures a 30-year fixed conforming loan, they could take out a loan up to $419,000.

Now let’s say rates rise 1 percentage point to 5 percent. With all the mortgage terms remaining equal, the borrower would have to adjust their budget to $372,500 in order to remain in their $2,000 monthly budget. That’s a difference of $46,500, or an 11% reduction in buying power.

In other words, as interest rates increase, the borrower’s buying power is reduced.

Why first-time buyers will be affected most

Many first-time buyers do not have a large down payment, and government and private lenders have changed their standards in order to accommodate these high earners with minimal savings. FHA loans can now be secured for as little as 3.5% down, while conventional (private) loans have a minimum of 3% down.

While these new minimums have prompted many first-time buyers to enter the market, it also means these buyers are relying heavily on loan-based financing. In fact, first-time buyers financed nearly 93% of their home purchase in 2021, meaning that on average, these buyers had saved an average of 7% for their down payment. (Repeat buyers, meanwhile, put down an average down payment of 17%.)

If rates were to rise 1 percentage point, most first-time buyers would not be able to increase their down payment to make up the difference in affordability. If rates increase, their only choice will be to lower their home buying budget.

How buyers can combat rising rates

By boosting your down payment, you may be able to offset the impact of rising interest rates. If saving a large sum of money seems difficult or even impossible, consider:

- Asking a friend or relative for mortgage gift funds. 24% of first-time buyers in 2021 used gift funds.

- Requesting a no-interest or low-interest loan from a family member or friend who can’t afford to gift you the money. 4% of last year’s first-buyers took loans from family or friends.

- First-time buyers can also apply for down payment assistance on many homes in our area, which can offset the stress of a rate increase.

Get help and advice on saving for a down payment.

Getting ready to buy

Prepping to buy your first home is an exciting time, and certain steps can put you in a better position with sellers. A pre-approval will tell you the loan amount you will qualify for, allowing you to set a responsible budget (and expectations) as you begin looking at properties online and in person.

Get pre-approved today, or contact us to get in contact with a local expert who specializes in your area.

Prosperity Home Mortgage, LLC may operate as Prosperity Home Mortgage, LLC dba Edina Realty Mortgage in Minnesota and Wisconsin. ©2024 Prosperity Home Mortgage, LLC dba Edina Realty Mortgage. (877) 275-1762. 3060 Williams Drive, Suite 600, Fairfax, VA 22031. All first mortgage products are provided by Prosperity Home Mortgage, LLC. Not all mortgage products may be available in all areas. Not all borrowers will qualify. NMLS ID #75164 (For licensing information go to: NMLS Consumer Access at http://www.nmlsconsumeraccess.org/) Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act. Licensed by the Delaware State Bank Commissioner. Georgia Residential Mortgage Licensee. Massachusetts Mortgage Lender and Mortgage Broker MC75164. Licensed by the NJ Department of Banking and Insurance. Licensed Mortgage Banker-NYS Department of Financial Services. Rhode Island Licensed Lender. Rhode Island Licensed Loan Broker. Rhode Island Licensed Third-Party Loan Servicer. Also licensed in AK, AL, AR, AZ, CO, CT, DC, FL, ID, IL, IN, KS, KY, LA, MD, ME, MI, MN, MO, MS, MT, NC, ND, NE, NH, NM, NV, OH, OK, OR, PA, SC, SD, TN, TX, UT, VA, VT, WA, WI, WV and WY.

©2026 Prosperity Home Mortgage LLC®. (877) 275-1762. 3060 Williams Drive, Suite 600, Fairfax, VA 22031. All first mortgage products are provided by Prosperity Home Mortgage, LLC®. Not all mortgage products may be available in all areas. Not all borrowers will qualify. NMLS ID #75164 (For licensing information go to: NMLS Consumer Access at

©2026 Prosperity Home Mortgage LLC®. (877) 275-1762. 3060 Williams Drive, Suite 600, Fairfax, VA 22031. All first mortgage products are provided by Prosperity Home Mortgage, LLC®. Not all mortgage products may be available in all areas. Not all borrowers will qualify. NMLS ID #75164 (For licensing information go to: NMLS Consumer Access at